How Do Biometric Payment Systems Ensure Secure Transactions?

The digitalizing world also brings with it some security risks. For this reason, technological developments in every field offer solutions and tools to ensure secure transactions. Since many financial transactions can now be completed even on a mobile phone, some advanced security measures are necessary for everyone.

The most common and secure payment systems are offered by different banks and financial institutions day by day. In my opinion, the most high-tech ones among these are biometric payment systems. Biometric payment systems are payment systems with advanced security that use physical features that are unique to each user.

The biological data used by biometric payment systems can be listed as follows:

- Fingerprint

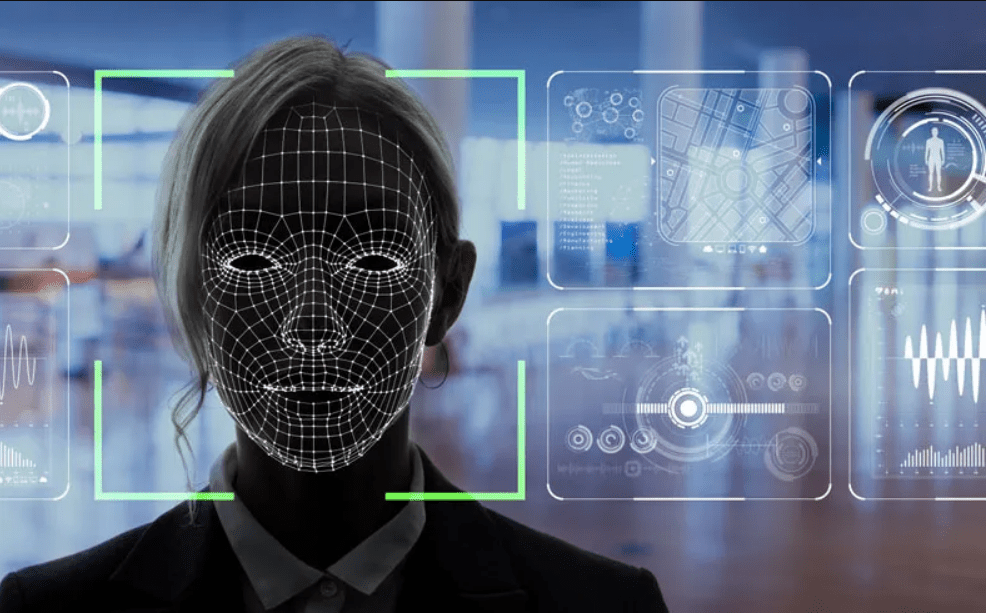

- Face recognition

- Iris scanning

- Voice recognition

Thanks to biometric payment systems, one of the common payment types of the future, the person who will make the payment can prevent someone else from making the payment transaction only with their biological data.

What Are Biometric Payment Systems And How Do They Work?

Although not all payment channels use biometric payment systems today, many online banking platforms and some traditional banks offer these payment systems to their customers. Biometric payment systems are advanced payment systems that use the biological data of the person making the payment, such as fingerprint, face, and tone of voice, as a security measure and make it impossible for someone else to make the payment.

Financial transactions, which are usually managed through mobile applications, can fall into the hands of someone else or a fraudster via a mobile phone. Thanks to biometric payment systems, even if your mobile phone falls into the hands of someone else, it is impossible for them to make payments or other financial transactions on your behalf.

Basically, biometric payment systems verify transactions by recognizing the unique physical characteristics of users. These physical characteristics usually use technologies such as fingerprint, face scanning, and voice recognition, which many smartphones can recognize.

How Do Biometric Payment Systems Prevent Fraud?

The most basic function of biometric payment systems is to prevent forgery or possible fraud cases. Financial platforms that offer biometric payment systems make it impossible for someone else to make a transaction because they use the unique biological data that customers have.

If you use traditional banking applications or payment systems, when someone gets their hands on your mobile phone, knowing your password is enough to make almost all financial transactions. However, thanks to modern financial applications where you can use biometric payment systems, forgery is prevented because your mobile phone or computer cannot use your physical data during the verification process even if it is in someone else’s hands.

The passwords you use for bank mobile applications can be passed on to someone else. However, the biological data used in the verification process of biometric payment systems cannot be copied. In this way, a high level of security is provided and forgery is prevented. To give a simple example of this technology, it can be unlocked with a face scan on many of today’s popular smartphones.

What Are The Security Benefits Of Using Biometric Payment Systems?

I can talk about the numerous security advantages of biometric payment systems. The most critical of these is that it is impossible to imitate or copy. As it is known, it is impossible to imitate someone else’s biological data in both fingerprint, voice tone, and face scanning technologies. Therefore, the most important advantage of biometric payment systems is that it is impossible to imitate due to the verification process using several features.

Another security advantage of biometric payment systems is that the process is completed more practically and easily. In payment systems managed with traditional security measures, periodically changing passwords and trying to remember them can make the process difficult. In addition, your passwords can be complicated to remember for different banks and applications. However, thanks to biometric payment systems, we do not need to remember any passwords and you can complete your payments in seconds with your fingerprint.

One of the biggest advantages of biometric payment systems is that financial transactions can only be made by you. Advanced technologies such as fingerprint recognition, face scanning, or voice scanning that we see in science fiction movies are now found on almost every smartphone. The spread of this advanced authentication method is also beneficial for the development of biometric payment systems for financial institutions.

How Do Biometric Payment Systems Compare To Traditional Payment Methods In Terms Of Security?

When we compare traditional payment methods with biometric payment systems, one of today’s advanced technologies, we can see that biometric payment systems are more advantageous in many different areas. While traditional methods are usually managed with users’ passwords and SMS verifications, biometric payment systems use tools such as fingerprint, facial recognition, or voice recognition, eliminating the possibility of fraud in traditional methods.

In traditional payment methods, an SMS code can sometimes be sufficient to verify the transaction. This situation is quite risky and creates security breaches in cases where our mobile phone falls into someone else’s hands. However, users who meet their financial needs with biometric payment systems do not experience security concerns in cases where their mobile phones or computers are stolen, since they verify with their unique physical features, fingerprint, or voice frequencies.

One of the most commonly used tools in traditional payment methods is bank cards. Especially since no password is required in contactless payment transactions, there may be possible fraud cases such as someone else using your card when it is lost. However, when you manage your financial transactions with biometric payment systems, it is possible to complete the payment physically or online within seconds after verification with a smartphone.

Can Biometric Payment Systems Be Hacked? How Are They Protected?

Every technology today is hackable, and theoretically, this probability is not 0 percent. However, both customers and financial institutions should take some security measures to reduce the possibility of possible hacking. However, almost every digital platform, even if it has international banks, has the potential to be scammed or hacked. It will be enough not to take some personal security measures. The financial institution you are transacting with should be reliable and reputable, and you should have your device’s security updates done completely. You can also use two-step verification methods to prevent possible data theft.

Among these, the technology that offers the highest level of security is biometric payment systems. Although someone else can’t perform a transaction since biological data is used in the verification process in these innovative payment systems, the theft of your biological data can lead to possible hacking cases.

Many financial institutions or banks allocate extra resources to hacking payment systems and ensure that the data is protected with strong algorithms. In addition to traditional security methods, fraud cases are very rare in digital and advanced biometric payment systems. Many international banks take advanced security measures for such cases.

How Do Biometric Payment Systems Use Encryption To Secure Transactions?

Biometric payment systems protect our physical and unique data such as fingerprints or voice frequencies with encryption. In general, many financial institutions encrypt this type of biological data with cryptographic tools and technologies. This reduces possible fraud cases to zero. Access by unauthorized devices or users becomes impossible.

Every customer expects a high level of security not only for payment transactions but also for other financial transactions. With the help of today’s digital banking tools, many different financial transactions such as asset transfers, bill payments, and e-commerce payments can be completed with biometric payment systems and infrastructures.

In these types of financial transactions, your personal and biological data are encrypted according to international security protocols with cryptographic technology. In this way, it provides a high level of security and transparency as in blockchain technology and networks. Possible fraud cases become impossible thanks to cryptographic encryption.

For financial transactions to be completed securely, biometric payment methods are encrypted with your personal and private data using technology such as encryption in blockchain technology. Thanks to this type of encryption, it is impossible for anyone else to perform financial transactions without your authorization.

What Are The Risks Associated With Biometric Payment Systems?

Some risks, although few, can be remembered for biometric payment systems. However, these innovative solutions, unlike traditional methods, carry much less risk compared to other payment systems. In biometric payment systems, your biological data is used in the identity verification phase before your assets are transferred to the recipient’s account.

At this stage, it may be possible for your biological data to be imitated, copied, and hacked. This can be remembered as the risks of biometric payment systems, causing possible fraud cases. However, this is impossible within the infrastructures of almost all financial institutions.

In traditional payment methods, even if someone else has your mobile phone, they can make many financial transactions on your behalf, while there is no such security concern for customers using biometric payment systems. For the payment to be completed, the customer’s unique physical features, such as voice, face, or fingerprint, must be verified.

How Do Biometric Payment Systems Protect User Privacy?

Many banks or financial institutions protect user privacy by complying with some international security standards while offering innovative payment methods to their customers. It is not possible for financial institutions that do not comply with security policies and standards to continue their operations.

Unlike traditional payment methods, biometric payment systems encrypt customers’ data with cryptographic methods and algorithms. As an example of a blockchain ecosystem, both high-level security and transparency are provided. Someone else’s ability to transact on your behalf is technologically prevented.

Users’ biological data is cryptographically encrypted and recorded in online ecosystems through algorithms. Therefore, customers’ data is not in an open and common pool that someone else can access. This process protects users’ privacy rights continuously.

How Do Biometric Payment Systems Ensure Secure Authentication?

I can claim that biometric payment systems complete identity verification most securely. Especially when compared to traditional payment methods, the data used by biometric systems for verification uses biologically unique and hard-to-imitate data, thus providing the most secure identity verification.

In other payment methods, traditional verification methods such as identity verification processes, SMS verification, and two-step verification are used. However, this is not an example of highly secure identity verification. In modern payment methods, when technologies such as fingerprint or face scanning, which are now available on smartphones that almost everyone has, are used, identity verification is provided at the highest level of security.

Since fingerprints are unique biological data for each customer, they provide a high level of security, like a type of cryptographic encryption. Perhaps manipulation or imitation is possible in facial recognition or voice scanning tools, but I think it is very interesting that fingerprint data cannot be copied. The use of this gift of nature in modern banking ecosystems is evaluated with biometric payment systems.

What Are The Best Practices For Using Biometric Payment Systems Safely?

Although biometric payment systems are one of the most secure payment methods, some practices can be recommended to maximize security. The most common of these is not to give devices that store our biometric data to others, to ensure the security conditions of devices or smartphones to regularly follow updates, and to use two-step verification tools.

In addition to these, the platform that uses our biometric data must also be reputable and reliable. In other words, the fact that an online banking platform uses biometric payment methods does not mean that the institution is a safe place. For this reason, the institutions or other financial platforms where you share your biometric data must also comply with global security standards and regulation policies.

If you have no doubts about the reputation and security of the bank or online banking platform you are transacting with, there is no problem in sharing your biological data. While an SMS code may be sufficient in traditional verification methods, a simple and practical identity verification process such as fingerprint scanning is sufficient in such innovative payment methods. You should share biological data, such as your fingerprint, voice frequency, or face, through only intermediaries with those you are sure are safe. Although many traditional banks currently offer technologies that allow biometric payment systems to be used in their mobile applications, it will become more widespread in the near future.

See you in the next post,

Anil UZUN