Understanding Currency Exchange Rates

Currency refers to the monetary resources used for financial activities by different countries and states. Nowadays, the currencies used by different countries and entities vary from one another. The differences in economic development between countries and the variability of economic value result in different currencies. The currencies used today provide information about the economic levels of countries and entities. The fact that a currency is positioned at a higher or lower price than another currency can be interpreted in different ways. This is because exchange rates and their effects change as currencies change. However, looking only at currencies does not provide a clear picture of a country’s development and financial situation. Different financial results and data should also be analyzed for this purpose. Nonetheless, currencies have different exchange rates and pricing with each other. Currency exchange rates are generally referred to as exchange rates and enable the conversion of currencies.

Currencies are primarily a result of countries’ economic indicators. Currencies are necessary for countries to engage in trade with each other and to conduct their activities. Different countries around the world use different currencies because they have different characteristics in commercial activities and transactions. Although currencies themselves do not carry a value, they are positioned on a certain value scale based on the conditions created around the world when they enter the markets. With the differentiation of currencies, countries direct their commercial activities and transactions in different ways. I believe that it is necessary to know the basic factors that add currency information to fully understand trade and investment worldwide. It may be appropriate for individuals and institutions involved in the investment field to receive education on the differences in currencies. Additionally, understanding the values and exchange rates of currencies will make it easier to direct investments.

Currencies And The Relationship Between Supply And Demand

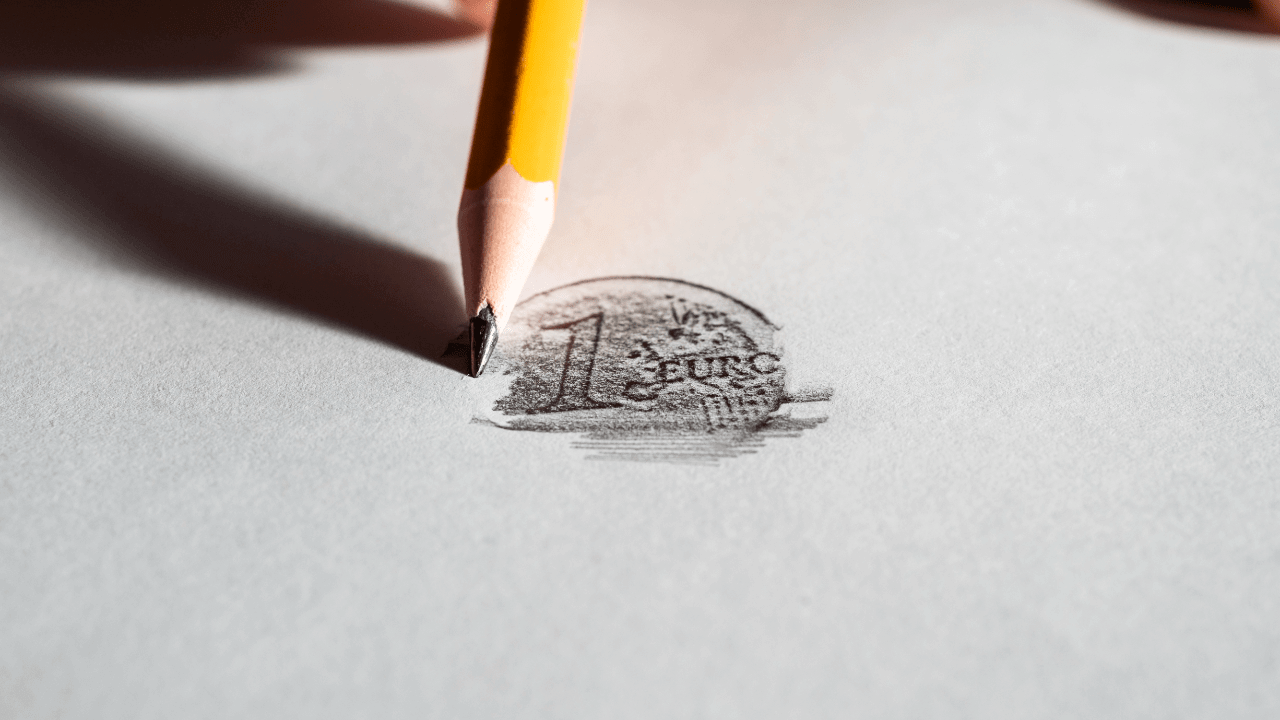

Commercial goods and services are priced according to the balance between supply and demand. Just like commercial goods and services, currencies are also subject to the same trade. Currencies are converted within a system called the foreign exchange rate. For example, the exchange rate and value of the dollar against the rupee constantly fluctuate. To purchase a chocolate bar using either rupees or dollars, you would need to pay different amounts of money. You may pay 5 units when paying with dollars or 50 units when paying with rupees. However, this does not necessarily mean that a chocolate bar is 10 times more valuable in a country that uses rupees than in a country that uses dollars. When we facilitate exchange and conversion between currencies, we can see that similar costs are incurred in both countries. However, the value of goods and services can vary depending on the currency. Since currencies are subject to financial transactions and markets around the world, their values are determined based on different economic criteria.

Countries’ currencies are subject to trading within markets. We can see that the value of a country’s currency rises when there is high demand for it. Especially among all global markets, the dollar and the euro are among the most traded instruments. We can say that the value of these currencies increases with high demand. In addition, valuations can be influenced not only by the presence of currencies in the currency markets but also by their use in commercial transactions. A significant portion of world trade is carried out using the dollar as a currency. Therefore, the dollar is among the most constantly increasing and valuable currencies all over the world. Its ability to be used in different parts of the world significantly increases the value of currencies. Similarly, some currencies do not attract much attention from investors and individuals. It can be observed that the value of a currency drops when there is no interest in it. The intense presence of currencies within markets will result in high supply. In this case, price reductions will occur just like with a consumer good or product.

The Impact Of Countries’ Characteristics On Their Currencies

One of the significant factors that affect currencies is the character of the countries. Although currencies are traded in markets, the features and qualities of a country are one of the fundamental factors affecting the value of its currency. Investors and individuals take the general condition of a country into account when purchasing a currency. The risk level and the likelihood of development in the currency’s country of origin are highly significant for investors and those in the market. Investors tend to focus on the currencies of countries with features that offer development opportunities and add value. Especially, investors primarily focus on currencies that can enhance their capital and provide returns. From this perspective, the Euro and the US Dollar are among the assets that are open to development.

Investors and users also evaluate the country where the currency is located based on risk factors. The currency being invested in is shaped by the developments and processes that the country will experience. In this regard, both positive and negative situations in which countries find themselves play a role in the factors that cause changes in currency value. Currencies of countries that provide opportunities for development and send positive signals on a global scale tend to increase in value. Additionally, the share of countries in world trade and their influence in international relations affect the value of their currencies. Currencies are not constantly stable due to these characteristics and effects of countries. We can say that currencies follow a fluctuating trend due to the different characteristics of countries. The fluctuating effects of exchange rates in the markets affect investors and many relationships.

Why Are Exchange Rates Of Currencies Important?

When it comes to commercial relationships between countries and states, the impact of currencies is seriously affected. Countries use currencies for their trade activities and transactions with each other. Therefore, the value of the country’s currency is crucial. As the currency of a country becomes worthless, the fact that the products and services it will receive will become more expensive emerges. Due to the differences in currencies between countries, relationships and commercial activities can be affected positively or negatively. In addition, countries engage in buying and selling products and services with different characteristics. Currencies are used in all transactions. Differences in currencies can create a situation where these relationships are interrupted or one side incurs losses. Along with all of these, a country’s interest rate policies, inflation situation, and national income rate are among the fundamental factors that affect the exchange rate of a currency. If inflation is increasing in a country and interest rate policies that will negatively affect the market are being pursued, currencies may experience a loss of value.

See you in the next post,

Anil UZUN