When Choosing A Bank, Things To Consider

Banks today offer a wide range of services and transactions that operate within a broad scope. Thanks to the developing technological structure of today, banking and finance transactions have become much easier. Significant changes have occurred in terms of quality, especially with the transfer of banking transactions to a different dimension, particularly through online banking. As a result of the differences in competition and services among banks, the level of preference for banks has changed. Users also tend to prefer banks that are the most convenient and efficient for their needs. Banks organize various campaigns and work to change users’ preferences. Additionally, important improvements have been made through efforts to develop technological infrastructure. Today, banks have reached a position where we can handle almost all transactions without going to a branch. However, there may still be significant differences between banks, even in today’s world.

Banks differ greatly in terms of their service offerings and transaction processes. Although bank selection may seem insignificant in many ways, it is important to consider it for all transactions to be carried out efficiently and effectively. Especially before selecting a bank, it is important to be informed about the opportunities and campaigns offered to you. Many banks organize significant benefits and campaigns for new customers. In this way, customers can gain significant advantages. Users who want to perform banking transactions obtain a more qualified service thanks to these advantages. However, one of the most important steps in bank selection is its ability to meet your needs. The reason for working with any bank and the transactions you will conduct will be the basic criteria in determining your selection. As many different transactions can be carried out through banks and applications, it is more appropriate to choose the one that suits your needs best. However, it is also possible to work with multiple banks that can meet your needs. In addition, many people can also use banking transactions for investment purposes. Therefore, working with institutions that offer you advantages in bank selection may be better for this purpose.

Which Banks Are There?

Banking and financial institutions come in a variety of different types. There can be many differences and structural changes among banks. Since banks have different approaches and characteristics, their service standards can be quite variable. Therefore, working with the bank that is most suitable for you will result in positive outcomes for all your transactions. However, knowing which banks are available and making comparisons can be beneficial. Currently, we can say that there are three different types of banks. The first of these are participation banks, which are institutions that operate on the principles of interest-free banking. Participation banks carry out interest-free transactions, unlike other institutions. Transactions are carried out based on profit-and-loss calculations. The funds of depositors in participation banks are invested in various fields. Especially, the created funds are intended to be shared among different sectors. Since participation banks have the principle of interest-free transactions, they have established a different advisory committee.

One important aspect of bank selection is whether it is a private or state-owned bank. There may be certain differences in terms of transactions between private and state-owned banks. Private banks are financial institutions that arise after the formation of individuals or certain partnerships. Private banks are not state-owned institutions. Different practices may be found between private and state-owned banks. Especially in terms of payments and loans, there may be significant differences between these two bank types. In addition, private banks may try to attract customers by organizing different campaigns according to their own decisions. However, it is not possible for state-owned banks to create campaigns personally and announce them to their customers. State-owned banks and private banks may have some advantages and disadvantages compared to each other.

Is Your Bank Accessible?

When choosing a bank, one of the most important factors is whether the institution is accessible or not. When working with a bank, you should be able to easily fulfill your transactions and needs. The branches and ATMs of a bank should be located in the desired locations. This is especially necessary for urgent needs or special situations like travel. Although every bank has mobile banking services today, we may still need to use ATMs for many transactions. In such a situation, the bank must be accessible. In addition, the bank should be accessible in case of an emergency. When you call the contact number in any situation, you should be able to speak with a customer representative. One of the fundamental problems at some banks is accessibility. Banks with low accessibility in terms of both ATMs and customer representatives are not often preferred by customers.

Banking Fees And Extra Payments

One of the most important factors for customers to consider when choosing a bank is whether or not it charges additional fees and expenses. Banking services may require fees and payments for certain transactions. However, there are significant differences among banks regarding these fees. While one bank may charge a high fee for a particular transaction, another bank may have a low-fee policy. This issue is particularly relevant for money transfers, where one bank may not charge any fees for transfers such as wire transfers or electronic funds transfers (EFTs), while another bank may charge high fees, especially after business hours. As a result, we can see that people who frequently transfer money tend to prefer banks that do not charge transfer fees. One of the main issues with fees and expenses is related to investment accounts. While one bank may charge low fees for users buying and selling investment instruments, another bank may charge high fees. Therefore, banks with low investment expenses are preferred. In addition, some banks may charge extra fees for using other bank cards when withdrawing money from an ATM.

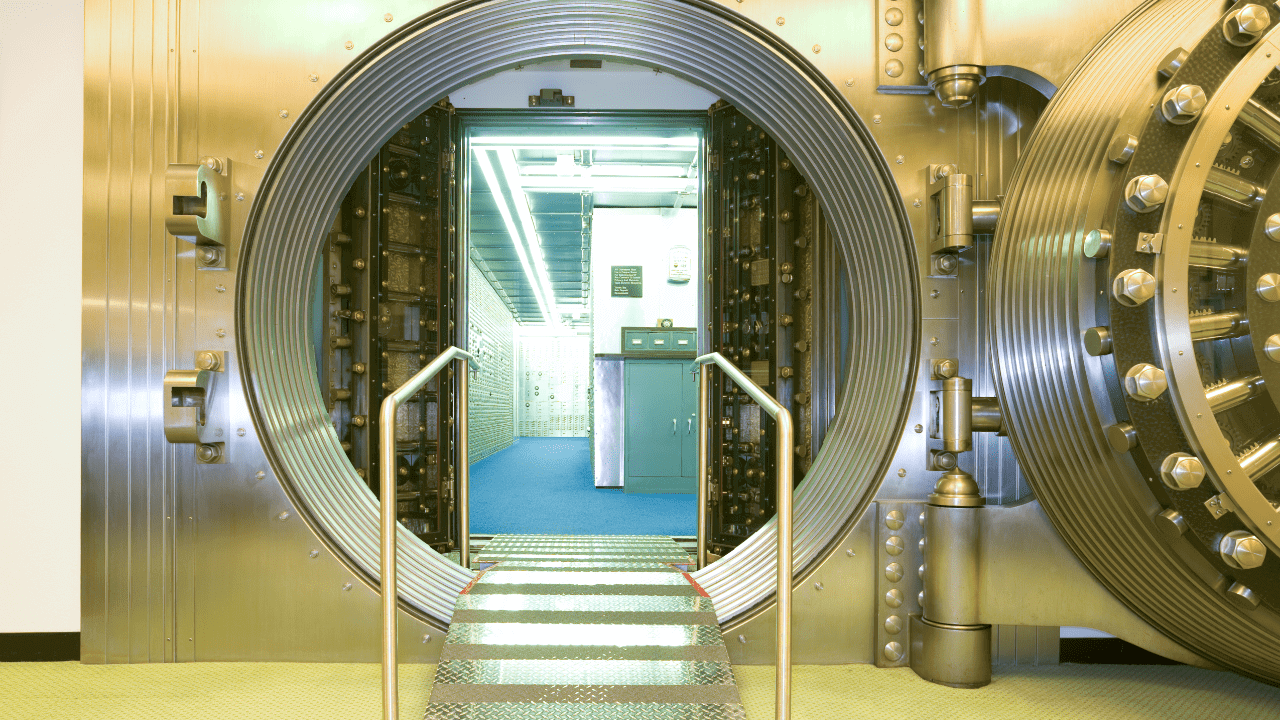

Is Your Bank Trustworthy?

One of the important factors in choosing a bank is whether it provides sufficient security measures. In today’s conditions, we may face many fraudulent and scam situations. Therefore, banks must be equipped with sufficient security measures, especially within the scope of mobile applications. A bank should make its customers feel safe and show that their assets carry no risk. Banks must have taken sufficient security measures both in their branches and with their mobile applications. Before choosing a bank, you can investigate whether the bank has previously encountered any security threats. In this way, you can be sure whether the bank is reliable or not.

Bank Transaction Limits

One important difference between banks is that they have different transaction limits. Banks can have different maximum transaction limits. Especially for someone who makes a lot of transactions during the day, transaction limits are quite necessary. Therefore, before choosing a bank, it would be appropriate to learn the level of transaction limits and make a choice accordingly.

See you in the next post,

Anil UZUN